Anti-Kickback Statute / Facility Discount Warnings

A guide to the AKS alerts located in AngelTrack's billing system

The Anti-Kickback Statute and EMS Ambulance Billing

The federal Anti-Kickback Statute [AKS], 42 U.S.C. § 1320a-7b(b), prohibits certain discounts to customers (hospitals and nursing homes) who refer Medicare and Medicaid patients for EMS services. It does not apply to business relationships where 100% of the patients are cash-pay or private insurance.

This is Not Legal Advice

This document is not legal advice, and AngelTrack LLC does not provide legal counsel. This document is not a full or sufficient treatment of the subject. This document is not a substitute for professional legal advice.

You should consult your legal counsel before setting any contract prices, before offering any discount or gift to any customer, and before charging or accepting any bounty for delegated calls. You can also contact your state's Office of the Attorney General / Office of the Inspector General for a written opinion on AKS compliance.

Federal Law 42 U.S.C. § 1320a-7b(b)

The Federal Anti-Kickback Statute [AKS] 42 U.S.C. § 1320a-7b(b) says:

- Whoever knowingly and willfully solicits or receives any remuneration (including any kickback, bribe, or rebate) directly or indirectly, overtly or covertly, in cash or in kind --

- in return for referring an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part under a Federal health care program, or

- in return for purchasing, leasing, ordering, or arranging for or recommending purchasing, leasing, or ordering any good, facility, service, or item for which payment may be made in whole or in part under a Federal health care program,

- Whoever knowingly and willfully offers or pays any remuneration (including any kickback, bribe, or rebate) directly or indirectly, overtly or covertly, in cash or in kind to any person to induce such person --

- to refer an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part under a Federal health care program, or

- to purchase, lease, order, or arrange for or recommend purchasing, leasing, or ordering any good, facility, service, or item for which payment may be made in whole or in part under a Federal health care program,

- Paragraphs (1) and (2) shall not apply to --

- a discount or other reduction in price obtained by a provider of services or other entity under a Federal health care program if the reduction in price is properly disclosed and appropriately reflected in the costs claimed or charges made by the provider or entity under a Federal health care program;

- [...]

In 2010 the Patient Protection and Affordable Care Act PL 111-148 clarified that an anti-kickback claim is a violation of the False Claims Act. This means that a violation of the Anti-Kickback Statute can result in loss of your Medicare and Medicaid numbers, among other penalties.

Intent Not Required

42 U.S.C. § 1320a-7b(h) of the Affordable Care Act clarified that the government does not have to prove that the defendant knew about the AKS and engaged in conduct with the intent to violate the AKS. The payment of the kickback is itself sufficient to establish guilt.

To wit:

"Section 6402(f) of Affordable Care Act [ACA] revises the evidentiary standard under the anti-kickback statute. ACA states that in order to establish a violation of Section 1128B of the Social Security Act, including the anti-kickback statute, a defendant does not have to have actual knowledge of, or specific intent to commit a violation of, the anti-kickback statute." -- Health Care Fraud and Abuse Laws Affecting Medicare and Medicaid: An Overview, September 8, 2014; 7-5700; RS22743, Jennifer A. Staman, Legislative Attorney for the Congressional Research Service

Dangerous EMS Practices

The following practices are common in the EMS industry but could be ruled to violate the AKS:

- free or below-retail wheelchair van service

- contract stretcher prices below the Medicare reimbursement rate for that ZIP code*

- free stretcher mileage

- patient copays waived

- meals, gift cards, and other perks for facility staff and administrators

- patient copays placed onto their nursing home's invoice

*If in doubt about the Medicare rates for a certain ZIP code, use AngelTrack's Medicare Rate Browser tool available under Billing Home.

Checking your contract prices against Medicare

AngelTrack will show you how your contract prices compare against the Medicare rates for the respective ZIP code. Visit the Pricing page under Billing Home and select any of the stretcher billing codes. The chart of prices will show each patient's and each facility's contract rates for that code, along with a percentage comparison against the Medicare rate.

Medicare rates usually change once a year. AngelTrack always has the current Medicare rates onboard. Use the Medicare Rate Browser tool under Billing Home to see what the rates are for your area.

Employees Receive a Bounty for Blowing the Whistle

An employee who blows the whistle on AKS violations occurring at your company will be paid a percentage of the amounts recovered in court. This means your employees (including ex-employees) have a financial incentive to report the aforementioned billing practices to the authorities.

Likewise for any employee or ex-employee of a nursing home or hospital, who blows the whistle on below-Medicare prices being offered to that facility.

Current Enforcement Efforts

The proliferation of kickback violations prompted the Department of Health and Human Services [HHS] and the Department of Justice to create in 2009 the Health Care Fraud Prevention and Enforcement Action Team, also known as HEAT.

Anti-kickback prosecutions now make up the majority of False Claims Act cases. And most states also have their own comparable anti-kickback laws, with their own enforcement divisions.

AKS Warnings in AngelTrack

AngelTrack has monitoring features which may serve as a warning in regards to the Anti-Kickback Statute. By reviewing each facility's history of insurance claims, AngelTrack determines which facilities are referring Medicare/Medicaid patients to you and hence subject to the AKS. This warning is therefore dependent upon your billing history with the facility: the warning will not function until that history has been established in AngelTrack. It is very important that you do not consider the absence of the warning as a guarantee that the AKS does not apply, nor should the warning be construed as proof that the AKS does apply.

Everyone in the billing office should always be aware of which facilities are subject to the AKS.

Discounts on facility invoices

If underpaying an invoice and selecting the option to write off the balance as a courtesy discount, AngelTrack checks the facility's billing history to determine whether it has referred any Medicare/Medicaid patients in the past year. If it has, then the AKS warning icon ![]() appears.

appears.

When the warning icon appears, handle it according to your company's policies as dictated by your billing director.

Forgiveness of patient copays and invoices

Writing off part or all of a patient's balance may violate the AKS. In that situation, if the patient cannot or will not pay, you must consult your legal counsel. One possible solution may be to establish a qualifying hardship policy.

Facility contract pricing

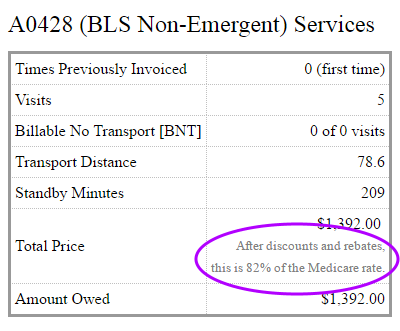

To help you steer clear of AKS violations in regards to facility contract pricing, AngelTrack looks up the effective Medicare rates for each contracted facility and then compares them to the facility's contract price. The difference in prices is expressed as a percentage in the Pricing page. Contact your legal counsel before establishing these prices.

The Regulatory Discount Safe Harbor

42 C.F.R. § 1001.952(h) provides a safe harbor for the giving and receiving of discounts off the published Medicare rates. Consult your legal counsel to make sure you qualify for the safe harbor before you need it.

Serious enforcement of the AKS is ongoing, and EMS companies and their nursing home and hospital customers have already been tagged with fines and sanctions.

Call centers, referrals, and bounties

If you are a call center, or if you delegate a large number of calls to other services, you probably receive a bounty for each delegated call. Federal regulation 42 CFR 1001.952 may constitute an exception to the Anti-Kickback Statute for this purpose, but your legal counsel must carefully review bounty arrangements to ensure that they qualify.

Help from AngelTrack's invoicing system

To support agencies attempting to quality for Safe Harbor, AngelTrack's invoices have two specific features:

- The template text shown on every facility invoice's cover page says:

Cost Reporting Entities are obligated to report discounts and/or rebates upon request by HHS.

If you require additional information to fulfill your annual cost report, please contact us.You can modify this text according to your legal team.

- Whenever the total charged price is below the Medicare rate, the discount percentage (including the value of any free miles) is automatically calculated and printed in the invoice, like this:

Further reading

For more background and precedent information about the AKS and the safe harbor, see:

- The Statutory Discount Exception, 42 U.S.C. § 1320a-7b(b)(3)(A) (SSA § 1128B(b)(3)(A))

- The Regulatory Discount Safe Harbor, 42 C.F.R. § 1001.952(h)

- The Anti-Kickback Statute, 42 U.S.C. § 1320a-7b(b) (SSA § 1128B(b))

- United States v. Shaw, 106 F. Supp.2d 103 (D. Mass. 2000)

- Klaczak v. Consolidated Medical Transport, N.D. Ill. 2006

- United States v. MacKenzie, et al. Rule 29 Motions and Decisions

- United States ex rel. Banigan, et al. v. Organon USA, Inc., D. MA (June 1, 2012)

As mentioned above, this document is not legal advice, and AngelTrack LLC does not provide legal counsel. This document is not a full or sufficient treatment of the subject. This document is not a substitute for professional legal advice.

You should consult your legal counsel before setting any contract prices, before offering any discount or gift to any customer, and before charging or accepting any bounty for delegated calls. You can also contact your state's Office of the Attorney General / Office of the Inspector General for a written opinion on AKS compliance.