Insurance Payor ID List / Payer ID List

Importing, Editing, and Using the Payor ID List

AngelTrack imports and stores your clearinghouse's payor ID list, so that you can lock your patient records to their carriers and thus be able to file electronic insurance claims.

What is a Payor ID?

A payor ID is short unique identifier for an insurance carrier, or for a group of related policies at a single carrier. A payor ID is typically composed of five letters and numbers; for example, "MR085" represents the Medicare MAC in Texas.

Some insurance carriers have multiple payor IDs, due to mergers and acquisitions of insurance pools. Some carriers have a single global payor ID, same for all clearinghouses to which they've connected; other carriers use a different payor ID for each clearinghouse.

Every clearinghouse has a list of payor IDs which it supports. That is to say, every clearinghouse has a list of insurance carriers for which it can route a claim. No clearinghouse supports every single insurance carrier; each clearinghouse usually specializes in a certain industry or region, in which it offers better coverage of the relevant carriers.

In order to file an electronic insurance claim, you must know the payor ID of the patient's insurance policy as seen by your clearinghouse. AngelTrack will help you find the correct payor ID.

Downloading a Clearinghouse's Payor ID List

In order for AngelTrack to help you find the correct payor ID for each patient insurance policy, it must know your clearinghouse's list of supported payor IDs.

Clearinghouses normally publish their payor ID list online, where you can download it in .CSV format suitable for import into AngelTrack. You may have to search for it. It might also be spelled "payer ID list", rather than "payor ID list".

When your AngelTrack server was first deployed, we pre-installed the payor ID list from the clearinghouse you specified. If you did not specify a clearinghouse, then we pre-installed the payor ID list from Office Ally.

Importing a Payor ID List Into AngelTrack

To import a fresh payor ID list into AngelTrack, use the Payor ID List Importer by clicking the ![]() button found at the top-right corner of the Insurance Payor ID List page, which can be accessed from the billing sidebar.

button found at the top-right corner of the Insurance Payor ID List page, which can be accessed from the billing sidebar.

You will need to have your clearinghouse's payor ID list already downloaded from them. The list must be in .CSV format. Follow the instructions provided by the importer in AngelTrack.

Before proceeding, carefully consider the options for patient insurance locks. In AngelTrack, an insurance lock means a patient policy where a biller has looked-up and attached the matching payor ID. If you are importing a brand new payor ID list, then an existing insurance lock might become invalid. For example, if your old payor ID list specified "04412" for Medicare part B in Texas, but the new payor ID list uses "TXMCR" instead, any patient insurance policy locked to "04412" could stop working. The importer will offer you the option to unlock any patient insurance policy where the locked payor ID is not present in the new list. When AngelTrack breaks those locks, all other patient policy data is preserved; only the payor ID is removed, so that the biller must look it up again and re-lock it.

Skipping non-claim payor IDs

If your list includes payor IDs that are not for 837P / Professional claims, i.e. if it includes payor IDs for 837D / Dental, 837I Institutional, 270/271 Eligibility, 276/277 Claim Status, or 835 Remits, then you won't want to import those rows into AngelTrack. To accomplish this, your list must have a column named "Transaction". AngelTrack will then import only those rows where the Transaction column includes the words "837P" or "Professional".

Carrier mailing addresses

The X12./5010 specification ended the requirement for the carrier's mailing address to be included in the 837P. Consequently, most clearinghouses no longer include mailing addresses in their payor ID lists. However, AngelTrack has the capability of recording a mailing address for each payor ID and will include that address where appropriate in any 837P or CMS-1500 that is bound for the carrier.

The payor ID list importer also supports mailing addresses if your clearinghouse has included them in their published list.

Manually Adding a Single Payor ID to AngelTrack

At any time, you can manually add another payor ID to the list in AngelTrack.

Simply visit the Insurance Payor ID List, which is accessible from a link the billing sidebar, and then click the ![]() button at the top-right corner of the grid.

button at the top-right corner of the grid.

You can create duplicate records on purpose, if you wish. For example, you could create two different records for payor ID "ABCDE" if two different insurance policy groups with very different names both refer to it.

Using the Payor ID List

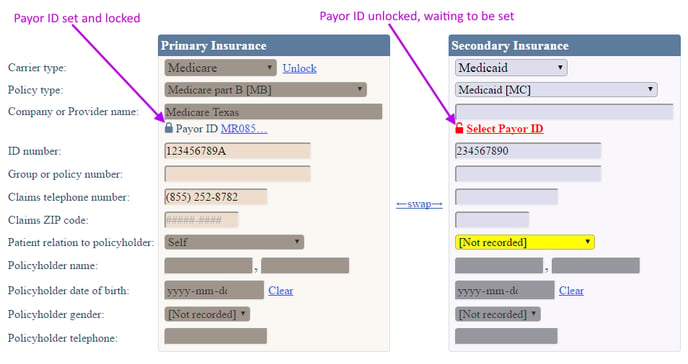

AngelTrack's payor ID list is used by billers who are looking-up and locking the payor ID for each of a patient's policies:

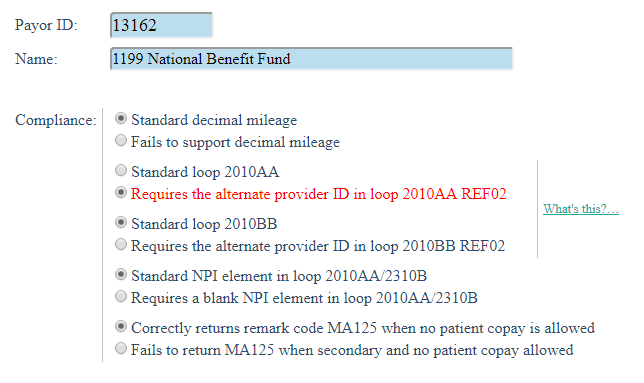

The payor ID list is also used to specify carrier-specific scrubs. A scrub is a custom edit to an insurance claim that is needed due to an idiosyncrasy at a certain carrier. For example, if a certain carrier does not allow decimal places in mileage claims, you can flag their insurance payor ID record as such, and then AngelTrack will automatically round the claimed mileage to the nearest whole number. You can see that option here, in this partial screenshot:

Some of AngelTrack's available scrubs pertain to electronic claims, some to paper claims, and some to both.

Some of AngelTrack's available scrubs pertain to electronic claims, some to paper claims, and some to both.

Automatic Creation of Payor ID Records

Under the following conditions, AngelTrack will automatically create a payor ID record and add it to your list:- A patient record has a primary policy locked, but no secondary policy;

- You file a claim against the primary;

- The primary carrier approves the claim, and says it automatically forwarded the claim to a secondary;

- The primary carrier reports the secondary carrier's payor ID in a NM1*TT loop.

AngelTrack does so in order to simplify the tracking of crossover claims where the patient record doesn't specify the secondary carrier. It will mark the auto-created payor ID record like this:

NOT FOR CLAIMS - This payor ID was auto-created to track crossover claims

Under these circumstances, the EOB Import page will also offer to store the crossover carrier's payor ID back into the patient record. However, crossover payor IDs are sometimes different from those known to your clearinghouse, so they may not work for the filing of a future claims when slotted as the primary carrier.