Reading a Paper EOB/SOB for EMS Ambulance Insurance Billing

An explanation of a paper EOB, including the CO-253 reduction aka the Sequestration aka the 2% CMS Mandate

If you are manually entering a paper EOB from Medicare or Medicaid, you must be aware of the CO-253 reduction -- also known as the 2% CMS Mandate -- and how AngelTrack handles it.

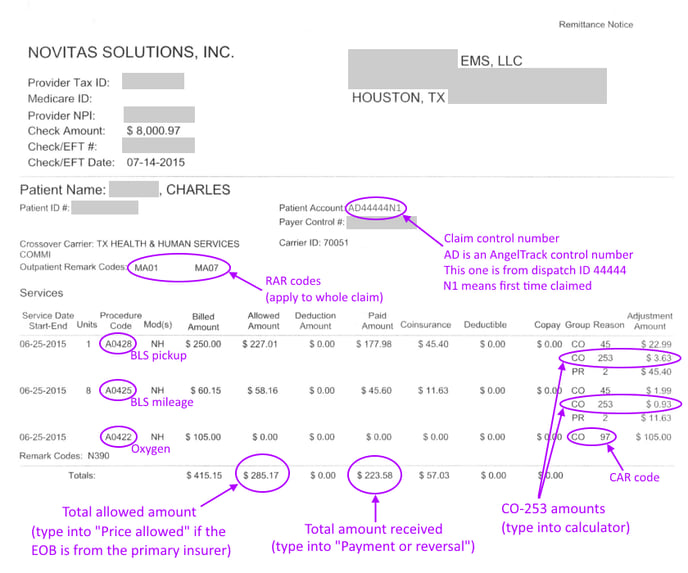

A Typical Paper EOB from Medicare

Here is a very typical paper EOB received from your MAC, in this case Novitas:

This EOB shows a BLS non-emergent stretcher call (A0428), from a nursing home to hospital (NH), with 8 miles of ground ambulance transport (A0425) and oxygen service (A0422). For this service, the EMS provider claimed $415.15. Medicare allowed a total charge of $285.17, refusing the oxygen charge (CO-97).

Of the $285.17 allowed charge, Medicare cut a check for $233.58 and left $57.03 as the patient's responsibility (aka "Coinsurance").

Oxygen claims are approved but do not pay anything

Notice the $105.00 claim for oxygen (A0422) was discounted to $0.00, with CO-97 given as the Claim Adjustment Reason [CAR] code. CO-97 means:

"The benefit for this service is included in the payment/allowance for another service/procedure that has already been adjudicated."This is Medicare's way of saying that oxygen is already priced into the A0428 BLS rate, so they aren't going to pay it as a separate line item. Thus the claim for oxygen is approved (a denial would be confusing) but not paid anything.

Understanding CAR codes

The dollar amounts in the rightmost columns are each accompanied by a "Claim Adjustment Reason" [CAR] code, explaining the reason for the adjustment. The code consists of two parts: the group and the reason.

The group takes one of five possible values, called "Claim Adjustment Group" [CAG] codes or just CAGCs:

- CO - Contractual Obligation. These adjustments were done in order to conform with the coverage contract in play. In the case of Medicare/Medicaid, the contract is the CMS regulations and rate tables.

- CR - Corrections and Reversal. These adjustments were done to correct an error in the claim or to claw back previous benefits paid in error.

- OA - Other Adjustment. All other reasons not fitting into the other four groups.

- PI - Payer Initiated Reductions. These are complicated. They are used to indicate that there is not a contract in play (i.e. an out-of-network service), but the payer (i.e. the insurance company) asserts that the adjustment is reasonable and defensible.

- PR - Patient Responsibility. These adjustments to the amount paid were done so as to leave a balance due from the patient (or the responsible party).

After the group is the reason code, giving specific details. In the oxygen example above, the CARC was CO-97, meaning the reduction was per contract, and the Medicare "contract" (i.e. the regulations) say that oxygen is already included in the pickup charge.

There are hundreds of different reason codes defined. You can find the full CARC list online. AngelTrack knows all of them and will decode them for you automatically.

The Numbers Don't Add Up (the Sequestration)

Look closer at the numbers in the sample EOB given above:

| Allowed amount: | $285.17 | |

| Amount paid: | - | $223.58 |

| Patient responsibility: | $57.03 ←error! |

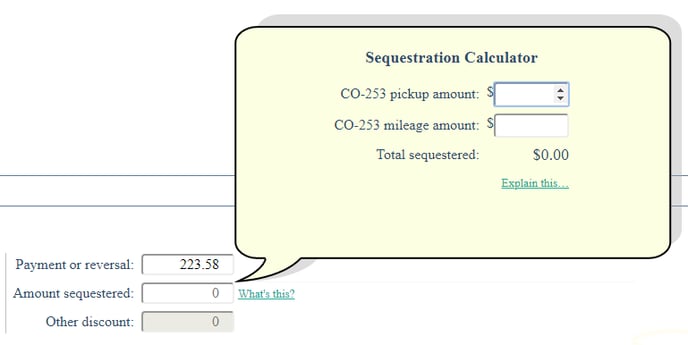

The math is wrong. There is $4.56 missing from that equation. The missing money is the CO-253 reductions:

| Allowed amount: | $285.17 | |

| Amount paid: | - | $223.58 |

| CO-253 reduction (pickup): | - | $3.63 |

| CO-253 reduction (mileage): | - | $0.93 |

| Patient responsibility: | $57.03 |

The CO-253 reductions, totaling $4.56, are pseudo-payments. They ought to be reflected in the "Allowed amount" because they are in fact disallowals, but that is not how it is done. Instead, they will be subtracted from the amount due -- as though they are payments received -- in order to balance the numbers.

AngelTrack's "Record a Payment Event" page, which is used to input paper EOBs, has a popup calculator to assist you in adding and inputting the amounts:

Affects only paper EOBs

This hassle with the math affects paper EOBs only. AngelTrack handles it automatically when importing EOBs electronically.

A few carriers do not do this

A few insurance carriers do not calculate their allowed amounts like this; instead, they pre-subtract the sequestration amount from the allowed amount in the manner that seems logical but which nevertheless diverges from the industry standard.

When AngelTrack sees an electronic EOB that does so, it will automatically correct it. If you are typing in a paper EOB that has the same problem, you will see that the calculated balance is lower than the patient's responsibility by the sequestration amount. In that case, you must manually add the sequestration amount to the price allowed.

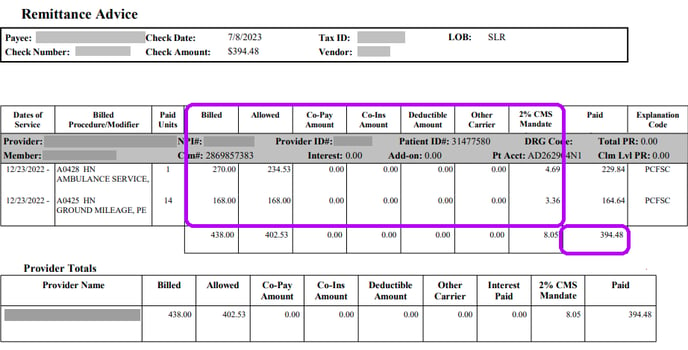

Interpreting a Low-Quality Paper EOB

Some carriers are bad citizens, sending out paper EOBs that are difficult to interpret.

Here is an example of a bad paper EOB:

For simplicity, let's just look at the line for A0428 HN.

The "Billed" amount is $270.00. That is the amount you originally claimed*.

The "Allowed" amount is $234.53, indicating a contractual discount of $35.47. Normally, a paper EOB will describe this amount as a CO-45 adjustment; CO-45 means "Charge exceeds fee schedule/maximum allowable". This EOB doesn't provide that, so you must calculate the $35.47 amount yourself, and assign it the CO-45 reason code.

The "Co-Pay Amount" / "Co-Ins Amount" / "Deductible Amount" columns contain the patient responsibility [PR]. In this case the PR is zero, i.e. the patient owes nothing, and so there is no need to file a claim against a secondary carrier, nor to invoice the patient.

The "2% CMS Mandate" amount is $4.69, which is the sequestration amount. A sequestered amount acts like any other adjustment: It reduces the amount owed to you. Its proper adjustment code is CO-253.

The "Paid" amount is $229.84, leaving no balance owing.

The "Explanation Code" is "PCFSC", which means "Priced Per Fee Schedule Rate". That is a fancy way of saying that all adjustments other than the sequestration were contractual discounts.

For the A0425 HN line (the mileage), no CO-45 reduction was applied, because the provider claimed exact Medicare rates for mileage; therefore the only reduction is the sequestration amount of $3.36.

So, here is how you would input that adjudication into AngelTrack:

- Amount received: $394.48

- Patient responsibility: $0.00

- Adjudication data for A0428 HN:

- Total claimed: $270.00 (already input for you)

- Adjustment: CO-45 for $35.47

- Adjustment: CO-253 for $4.69

- Adjudication data for A0425 HN:

- Total claimed: $168.00 (already input for you)

- Adjustment: CO-253 for $3.36

*This claimed dollar amount ($270) is low compared to retail prices, because this provider is claiming Medicare rates instead of retail rates. It may or may not be necessary to do this; ask your legal counsel and your CACO for advice.

CO-253 Reductions Explained

CO-253 is a Claim Adjustment Reason [CAR] code that officially means "Sequestration - reduction in federal payment".... or simply "the sequestration". It is also referred to as the "CMS 2% Mandate".

The sequestration is an across-the-board federal spending cut affecting a broad swath of programs, including Medicare. In the case of EMS, this means a flat percentage reduction in all amounts owed to EMS providers. There is no chance of appeal; you simply get paid less than what you are owed, and you cannot invoice anyone else to recapture the loss.

The sequestration is listed separately on an EOB, rather than being automatically factored in to the allowed amount, so as not to confuse people and software programs that are comparing the Medicare rate tables against the allowed amount to check for discrepancies. By listing the sequestration amount separately, the allowed amount will still match the rate tables, and the rate tables do not need to be re-adjusted whenever the sequestration is increased or decreased. Unfortunately, this means that anyone typing in their EOBs must input the sequestered amounts themself in order to balance the allowed amount, the amount paid, and the patient responsibility.

AngelTrack considers the sequestered amount as a quasi-payment, which reduces the balance owed (and the accrued revenue) even though it is not cash received. It simultaneously is and is not a payment.

Clear it with your legal team first

AngelTrack stores the sequestered amounts separately so that they appear as a separate column in the Revenue Accrual and related reports. Your accountant will know whether and how to apply the sequestered amounts to your books and taxes.

Before using any data from AngelTrack concerning revenue, collections, or write-offs, you should consult your legal team. Taxes and deductions in the healthcare industry are complex, especially when Medicare/Medicaid writedowns are in play. It is easy to make a serious and costly mistake, so don't proceed without first talking to experts.

Reporting on Sequestration Amounts

There are several places in AngelTrack where you can pull statistics for the CO-253 amounts deducted from your insurance revenue:

- Revenue Accrual Report shows the sequestration total for each month

- Revenue Accrual Detail shows each individual sequestration as a line item

- Line Items Report shows each dispatch's sequestration amount as a column named "Amount Sequester"

- Report Builder's "Dispatches-Financial" dataset shows each dispatch's sequestration amount as a column which can be used for SUMs, AVGs, and filters

Filing an Electronic Secondary Claim

If you wish to electronically file against a secondary carrier after receiving a paper EOB from the primary, follow these steps:

- Use Record a Payment Event to input the paper EOB.

- When doing that, click "Input the adjustments from a paper EOB" and input the chart of CARCs.

- If manually deciding your "Next Steps", send the call back to "Billing Office", and leave the Payor set to "Insurance".

- The dispatch will reappear in the Insurance Filing Queue and will already be switched to the secondary.

- Batch up the dispatch, and send the batch to your clearinghouse, or let AngelTrack's automatic clearinghouse uploader send it for you.