Writeoffs, Including Trips Sold to Collections

A guide to the automatic and manual writeoff accounting systems

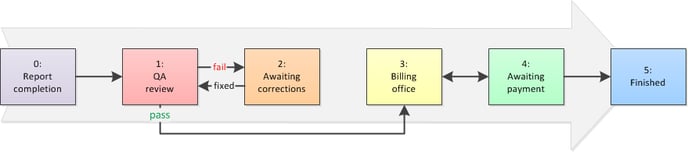

In AngelTrack, a writeoff occurs whenever a dispatch advances to "Finished" while still having a balance due. This can occur during a sale to collections, or a biller can do it manually.

That's all. You do not need to take any further steps to write off an outstanding debt. You may also reverse this decision at any moment in the future by returning the dispatch to the post-process workflow.

That's all. You do not need to take any further steps to write off an outstanding debt. You may also reverse this decision at any moment in the future by returning the dispatch to the post-process workflow.

Because the dispatch is marked "Finished" while still not fully paid, the balance will appear as a writeoff in AngelTrack's tax and revenue reports. Remember that the revenues from any sale to collections should eventually be reflected (as cash received) in your agency's financial records – a monetary amount not recorded by AngelTrack.

Cancelled and Non-Billable Trips are Not Writeoffs

If a dispatch is marked "Cancelled", it proceeds immediately to "Finished" and is not a writeoff, even if it has a price quote.

If a dispatch is marked non-billable, it must still go through QA review, but afterward it proceeds to "Finished" and is likewise not a writeoff, even if it has a price quote.

You can still pull reports on the price quotes of your non-billable dispatches, in case you want to calculate the dollar value of your non-billable work.

Sold Trips are Writeoffs

As far as AngelTrack is concerned, any dispatch sold to collections is a writeoff, because AngelTrack does not later reconcile any revenue returned by the collections agency.

When you sell a trip to collections, AngelTrack does all of the following:

- Advance the dispatch to "Finished", thus removing it from the workflow;

- Set the dispatch's balance due to zero;

- Set the dispatch's amount-written-off to the monetary amount still owing;

- Auto-create a special payment event record to indicate the date and monetary amount of the sale to collections (see below); and

- Offer to download to you a spreadsheet of data needed by your collections agency.

Note that AngelTrack uses invoices to manage the sale of receivables to collections. The invoicers have a special "Collections" mode that can automatically gather together all trips that have been previously invoiced a certain number of times. To learn more, refer to the Invoicing Guide.

Written-Off Dispatches Must Have a Price

Because write-offs have important tax implications, and because AngelTrack's reports are sometimes used to calculate taxes, AngelTrack requires all written-off dispatches to have a price quote or a price allowed. This permits the tax and revenue reports to calculate the amount that was written off.

Therefore, whenever a dispatch advances to "Finished" but doesn't have a price yet, AngelTrack will automatically price it at retail.

Writeoff Event Tracking

Any writeoff of a dispatch -- including any sale to collections -- will appear in AngelTrack as a payment event record.

This record is automatically created and maintained by AngelTrack, and it cannot be edited except to add comments. The record's event type will be "Writeoff" or "Sale to collections", depending whether the associated dispatch belongs to any invoice that is marked "Sold".

If the associated dispatch is later un-written-off, i.e. is pulled back into the workflow, then AngelTrack will automatically mark the payment event record as deleted.

Each dispatch can only ever have one such payment event record. Therefore, if any monetary amounts ever change, AngelTrack will update the payment event record to show the new totals. It will not ever create a second payment event record for the writeoff or sale to collections.

Counterparty tracking

In the automatic sold/writeoff payment event record, the "Received from" field will always reflect who the current payor was at the moment of writeoff. Therefore, you can use these payment event records to easily organize your sold/written-off amounts by counterparty, to see who is incurring the most losses.

Writing Off Dispatches Using an Invoice

AngelTrack's invoicing system makes it easy to write off multiple receivables at once.

To write off all dispatches in an invoice, mark the invoice "Paid" and specify zero dollars as the amount paid, and select the ☑ Write off unpaid items as a courtesy discount option. AngelTrack will automatically move the underlying dispatches to Finished, leaving notes in their journals to that effect.

To sell all dispatches in an invoice to a collections agency, and therefore to mark all of them as sold (and thus written off), mark the invoice "Sold". To learn more about using invoices to sell receivables to a collections agency, refer to the Sold Receivables Guide.

Facility Writeoffs Versus the Anti-Kickback Statute

If writing off some or all of a facility invoice, you may be subject to the Anti-Kickback Statute.

If AngelTrack sees that the facility in question has sent you any Medicare or Medicaid business in the past year, then the AKS warning icon ![]() will appear if you tick the ☑ Write off unpaid items as a courtesy discount checkbox.

will appear if you tick the ☑ Write off unpaid items as a courtesy discount checkbox.

If a contracted facility asks for a write-off of some of their invoices or asks you to place patient copays onto the facility's invoice, this may expose your agency to AKS prosecution.

Patient Writeoffs Versus the Anti-Kickback Statute

If writing off patient copays that remain after Medicare or Medicaid benefits are paid, writing off these copays may expose your agency to the Anti-Kickback Statute because those write-offs may be seen as a cash benefit paid to obtain future government-subsidized stretcher business. Your legal counsel may suggest a hardship policy.

Invoice Payments Against Written-Off Dispatches

If an invoice contains a written-off dispatch (including a writeoff due to a sale to collections), and you make a payment against the invoice, AngelTrack will apply the monetary amount to all of the invoice's unfinished items first. If all unfinished items become paid in full yet there is leftover money, AngelTrack will apply it to the written-off items, attempting to recoup the loss and bring all written-off amounts back to zero.

Where that succeeds, and a previously written-off dispatch becomes paid in full, AngelTrack will then auto-delete the special payment event record that marked the date and amount of the writeoff.

Reviewing Written-Off Dispatches

There are several ways to review your written-off balances, including those which you sold to collections:

The Payment Event Finder can filter to events of type "Writeoffs", which includes any sales to collections.

The Line Items Report indicates writeoffs -- including sales to collections -- in its "Postprocess Status" column.

The Invoice Sold Calls Report shows all writeoffs which resulted from the sale of an invoice to collections.

The Revenue Accrual Report tallies up all writeoffs -- including sales to collections -- among its "Adjustments" columns. Furthermore, it has a dive-down report called the Revenue Accrual Detail Report, which shows all financial activity for any selected month, and which can be filtered to show only writeoffs that occurred during any month.

Report Builder's "Dispatches-Financial" dataset includes columns for identifying and analyzing writeoffs, including sales to collections.

If you find a writeoff that was made in error, then simply open the associated dispatch record, and use the "Billing" tab to push it back into the post-process workflow.

Reviewing Written-Off Ledger Entries

You can write off a ledger entry (facility, affiliate, or patient) by creating a balancing entry and choosing the option ☑ Write off this amount from their ledger.

To later pull a report on such ledger entries, use Report Builder's "Ledgers-Affiliates", "Ledgers-Facilities", and "Ledgers-Patients" datasets, and filter based on the "Is Writeoff" column.

"Negative Writeoffs" / Credit Balances Left on Dispatches

Normally, AngelTrack will move any credit balances (overpayments) over to the counterparty's ledger, so they can be applied to other receivables. However, if a biller prevented AngelTrack from doing this (using the options on the Invoice Pay page), such that a credit balance remains on a finished dispatch, then AngelTrack will report the balance as a "negative writeoff" i.e. as a reduction in the total written-off amount for the time period.

Overpayments from insurance are different, because there is not an automatic invoicing mechanism by which to settle them. Instead, AngelTrack will leave the overpayment on the dispatch, and move it to "Finished" where it will await the eventual clawback from the carrier. When the clawback arrives, AngelTrack will understand what happened, and will un-finish the call and then bill the patient for any PR, as necessary... but until that happens, AngelTrack will report the overpayment balance as a "negative writeoff" among all other writeoffs during the time period.

Clear This With Your Legal Team First

The foregoing is not legal advice.

Before using any data from AngelTrack concerning revenue, collections, or writeoffs, you should consult your legal team and your accountant. Taxes and deductions in the healthcare industry are complex, especially when Medicare/Medicaid writedowns are in play.